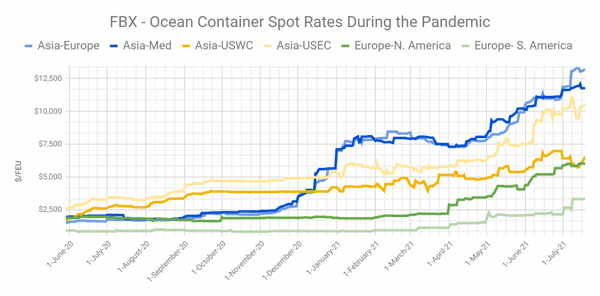

Ocean freight rates have soared greatly for all trade routes since September 2020 due to the ongoing impacts of the COVID-19 pandemic.

The freight rates in August 2021 reached $10,174/TEU, an increase of 466% in 2020.

- Asia-US West Coast rates shot up to $18,346/TEU, more than 6x its level a year ago.

- Asia-US East Coast costs climbed to $19,620/TEU, 487% higher than last July.

- Asia-North Europe prices rocketed to $13,706/TEU, which also rose by more than 250% in the comparable period last year.

There is, however, little sign of a decrease in ocean shipping costs in the short term. Ocean freight rate continues to rise dramatically until Q4 2021 due to two peak seasons. We know international freight is not always smooth, and there are the two busiest times in the shipping year (also known as peak seasons).

The first lasts from mid-August through mid-October, before the peak holiday retail season. The second one is spurred by Lunar New Year in some Asian countries, often in January or February. The global demand is strong during these times, while container capacity can become scarce, ocean shipping costs will set new highs.

With the soaring freight rates, 2021 is truly a challenging year for both exporters and importers because around 80% of all global goods are transported by sea. This great increase has been seen after the outbreak and spread of the COVID-19 pandemic. Then is the peak holiday shopping season.

The trade imbalances are the main cause that pushes ocean freight rates up significantly. When the COVID-19 started to rage, production came to a halt. Countries across the globe lockdown and open up at different times. It caused an imbalance between supply and demand for goods. Moreover, shipping companies had to reduce the capacity on major routes. Port delays and closures occurred. It then led to a shortage of return cargo from destination ports and empty containers for export.

Port delays and closures have caused a shortage of empty containers

During the recovery time, the increase in consumer demand is stronger than expected, particularly in the sectors closely associated with international trade. Competition for ocean freight capacity has also become intense. Which has pushed the ocean freight much higher than the previous year.

Currently, to keep up with the burgeoning consumer demand, retailers are hustling to restock their inventory, particularly for the peak holiday shopping season. But with delays and closures in ocean freight, many have to place peak season orders early. It’s all about avoiding congestion and being ‘stuck’ without back-to-school and other seasonal inventories.

As a result of the increased demand, freight costs have climbed on most lanes, with some carriers adding early peak surcharges to the already sky-high shipping rates.

There is currently no container production in Vietnam. Therefore, in response to this shortage of containers at ports, steel giant Hoa Phat Group plans to set up its first container factory in the southern region. , it is expected to manufacture 500,000 TEU containers annually. This steelmaker will focus on popular container products, with a length of 20-40 feet. Those containers produced by Hoa Phat will be launched on the market at the beginning of Q2 2022.

For more refractory news and updates, follow us on LinkedIn. For sales, contact us here.